W2 payroll tax calculator

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. That result is the tax withholding amount.

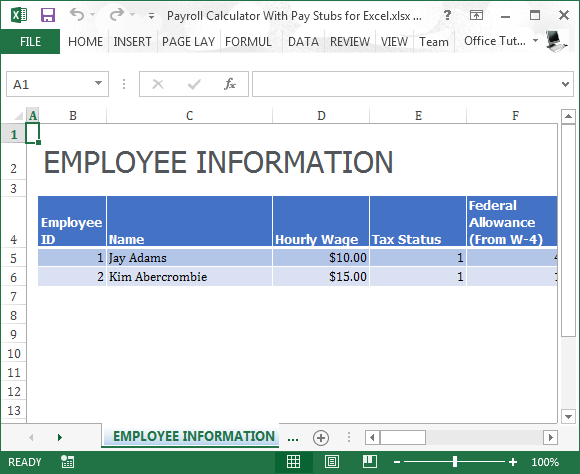

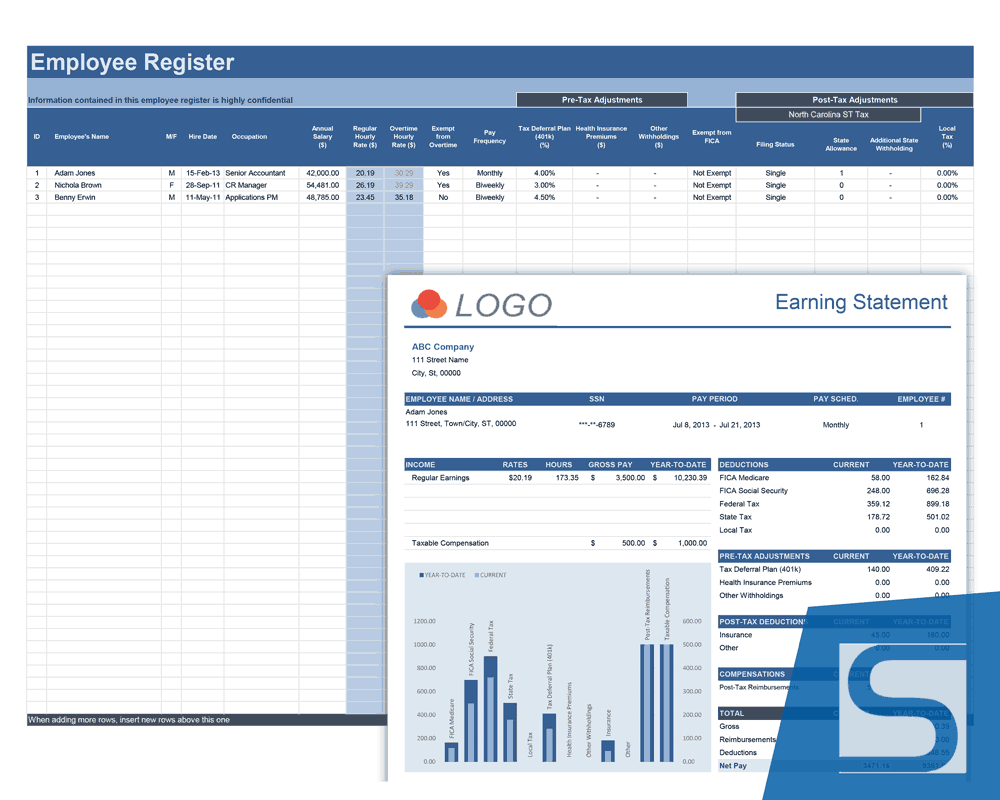

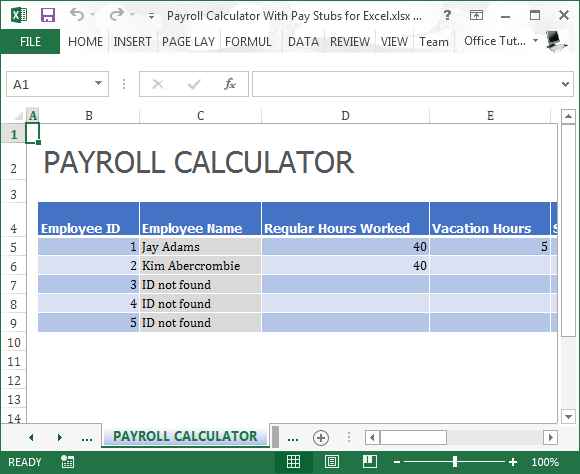

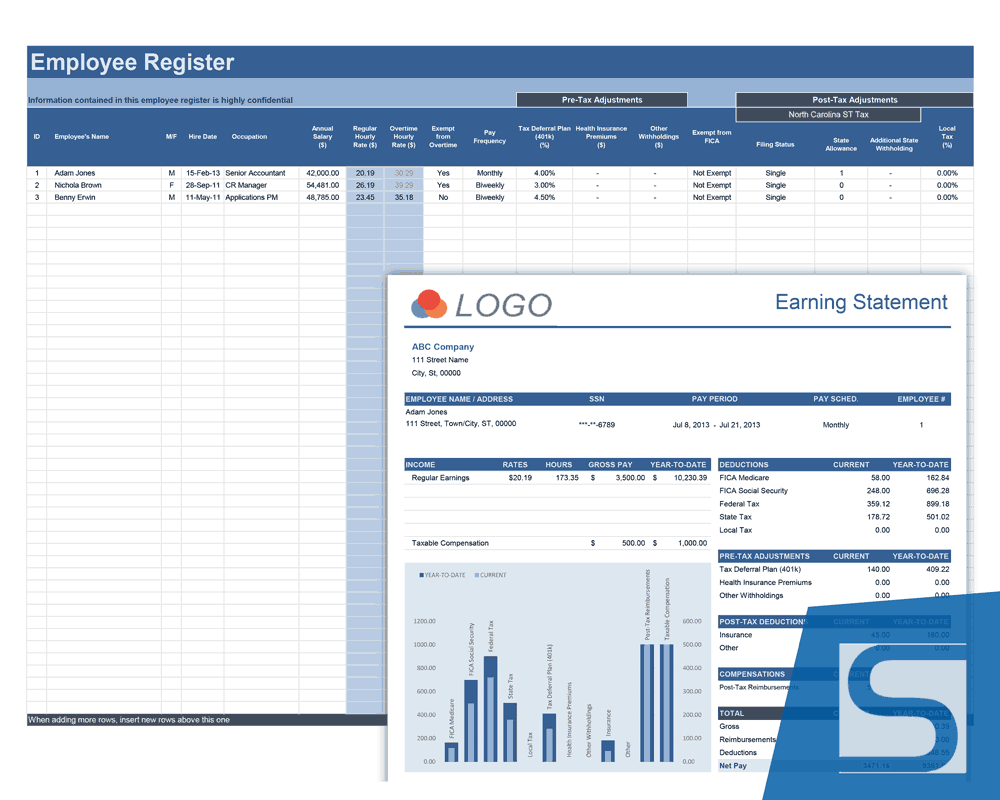

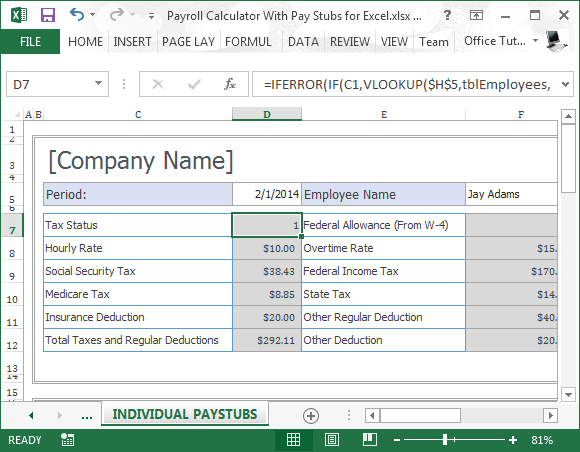

Payroll Calculator With Pay Stubs For Excel

Both you and your employee will be taxed 62 up to 788640 each with the current wage base.

. Medicare 145 of an employees annual salary 1. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. The maximum an employee will pay in 2022 is 911400.

This number is the gross pay per pay period. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Then look at your last paychecks tax withholding amount eg.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. If you work for. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

Your employees FICA contributions should be deducted from their wages. Heres a step-by-step guide to walk you through. Free 2022 Employee Payroll Deductions Calculator.

250 and subtract the refund adjust amount from that. Use this simplified payroll deductions calculator to help you determine your net paycheck. Withholding schedules rules and rates are.

All Fields Required Get Started Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the. Could be decreased due to state unemployment. The information you give your employer on Form W4.

Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. You can use the Tax Withholding. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your.

Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. IRS tax forms. For help with your withholding you may use the Tax Withholding Estimator.

Gross Pay Calculator Plug in the amount of money youd like to take home. 250 minus 200 50. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Payroll taxes are automatically assessed by all W2 employers in the United States. Subtract any deductions and. You can enter your current payroll information and deductions and.

Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Therefore if you have a traditional W2 job then you should see taxes being withheld. The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is.

Payroll Calculator With Pay Stubs For Excel

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Free Self Employment Tax Calculator Shared Economy Tax

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax Calculator For Employers Gusto

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Taxable Income H R Block

Payroll Calculator With Pay Stubs For Excel

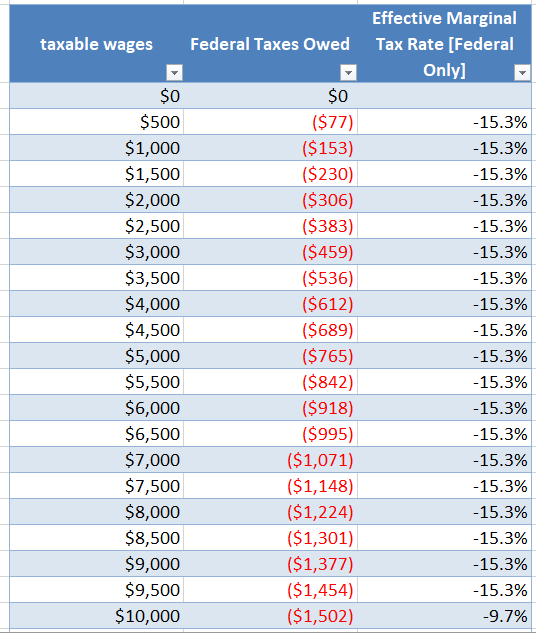

2021 Tax Calculator Frugal Professor

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Small Business Payroll Taxes How To Calculate And How To Withhold Netsuite

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Payroll Tax What It Is How To Calculate It Bench Accounting

Employer Payroll Tax Calculator Incfile Com

How To Calculate Federal Withholding Tax Youtube